China spots an easy mark

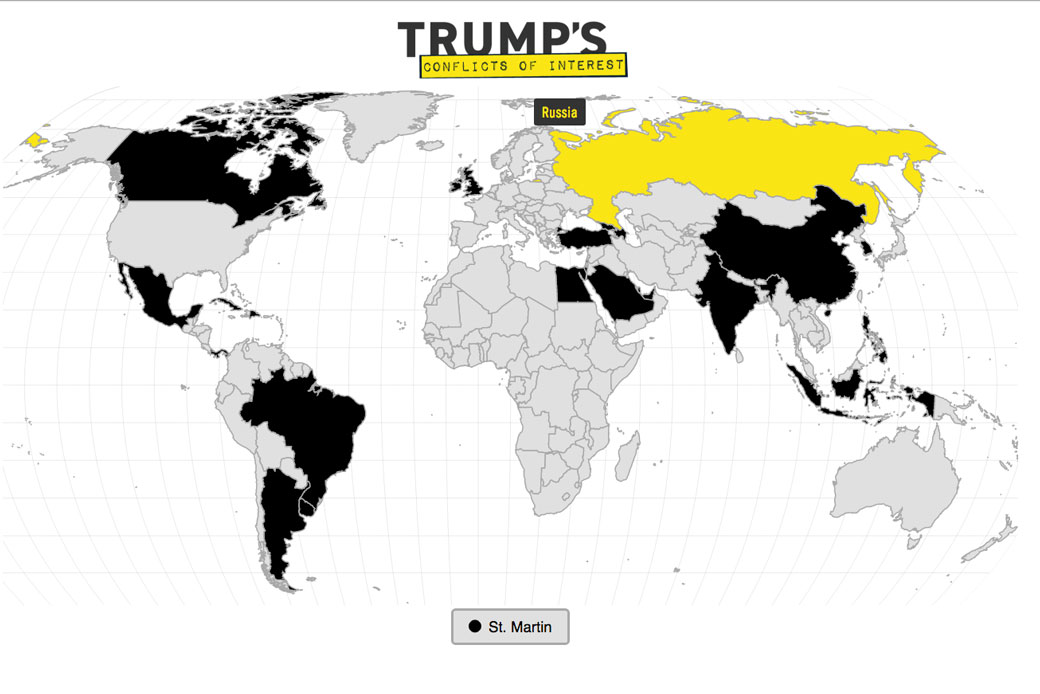

Before becoming the 45th president, Donald Trump’s efforts to develop businesses in China were most notable for their failures. A 2008 deal with the Chinese Evergrande Group to develop an office complex never came to fruition, and a 2012 deal with the electric utility State Grid Corporation of China to develop property in Beijing fell apart after State Grid was found to have been illegally using public land for the project. In October 2016, Chinese news media quoted Trump Hotel’s—formerly Trump Hotel Collection’s—CEO Eric Danziger telling attendees of a hospitality conference in Hong Kong that the group was still planning to open Trump hotels in 20 to 30 Chinese cities, as well as Scion—the brand Trump’s sons are planning to expand—hotels in other cities. These comments showed a remarkable level of ambition given Trump’s stalled efforts in China up to that time.

Indeed, Trump had tried for more than a decade to register trademarks in China to provide “construction-information,” essentially real estate agent, services in that country, only to be met with a series of unsuccessful rulings and appeals. Since 2005, Trump has applied for at least 130 trademarks in China, all of which—until recently—were met with zero success.

What is very important to note about China is how heavily involved the ruling Communist Party of China (CPC) is in all decision-making processes, not only across all government agencies but also in the judiciary, which is not independent, as well as in state-owned enterprises, which include state-run banks. Regarding state-owned enterprises, China’s President Xi Jinping recently reminded these companies that the CPC has ultimate say over their decisions, stating, “Party leadership and building the role of the party are the root and soul for state-owned enterprises. The party’s leadership in state-owned enterprises is a major political principle, and that principle must be insisted on.” As such, any decisions made at state-owned enterprises are invariably influenced—and sometimes made—by the Chinese government, including decisions regarding the hiring, firing, and promotion of individuals who work in these enterprises.

Here is the danger of Trump’s conflicts of interest for the United States. Prior to taking office, on December 2, 2016, Trump spoke with Taiwanese President Tsai Ing-wen on the phone in an extraordinary breach of decades of U.S. foreign policy and protocol regarding China and Taiwan. Shortly after the call, it emerged that the Trump Organization was reportedly exploring the expansion of its business into Taiwan, reports that the organization has denied. In a televised interview, the mayor of Taoyuan, Taiwan, said that he had met with a representative of the Trump Organization in September to discuss possible real estate projects, and at least one Trump employee was found to have posted that she was in Taiwan on a business trip at the time.

As summarized in an Atlantic article, “The president of the United States breached decades of international protocol created to preserve a precarious balance of power. That decision raised not only the possibility that Trump was blundering into a potential international incident but also that he may have done so in part out of consideration for his business prospects.”

And then, lo and behold, China’s approval of one of Trump’s trademark applications became official—coincidentally only a few days after Trump reversed his previous position and endorsed the “one China” policy. This policy effectively recognizes the People’s Republic of China as the legitimate government of the mainland territory while allowing the U.S. government to have unofficial relations with Taiwan, governed by the Republic of China. In March 2017, China granted preliminary approval for 38 additional Trump trademarks, applications for which had been submitted in April 2016. While there are conflicting views about whether the process and timing of Trump’s recent trademark approvals are suspect, the reality of the matter is that in China, every administrative or judicial decision is a political one based on the government’s preferences and priorities; courts in China are not independent, but rather they report directly to the CPC. Also of note here is the fact that foreign companies have historically struggled to get equal treatment under Chinese law, so decisions in favor of a foreign company are striking. It is hard to avoid the appearance that China was giving Trump the trademarks in exchange for a direct shift in policy. As another Atlantic article points out: “Each subsequent ruling in his favor will serve to remind Trump of the personal profits he could reap by improving his own personal relations with China, even if doing so leaves the American people worse off.”

And the web of conflicts and Chinese influence on Donald Trump and the Trump family extends well beyond the longstanding trademarks issue.

In February, in its first major real estate transaction after Trump’s inauguration, the Trump Organization sold a $15.8 million penthouse apartment in Trump Tower to Chinese-American business executive Xiao Yan Chen, who also goes by the name Angela Chen and has been directly linked to a front group for Chinese military intelligence through the misleadingly innocuous-sounding China Arts Foundation. A 2011 congressional report was quite blunt in labeling the China Arts Foundation as “a front organization for the International Liaison Department of the People’s Liberation Army’s General Political Department.” Chen also founded and is currently the managing director of a business consulting firm called Global Alliance Associates, which “facilitates access and establishes critical strategic relationships with the most influential public and private decision makers” in China by mobilizing its “extensive network of relationships with the highest levels of government officials—at national, regional and local levels—to facilitate immediate, efficient and skillful access into the Chinese market place.” Neither Chen nor the China Arts Foundation replied to requests for comment from reporters.

While President Trump has removed himself from the board of directors of the corporation that runs Trump Tower, he still owns the company and thus continues to profit from it. This puts Trump in a position to profit from an individual—Xiao Yan Chen—who has ties to the highest echelons of the Chinese government and military and who would benefit enormously from access to the U.S. government.

Trump has been dependent on Chinese money for quite a while. According to an investigation by The New York Times, Trump holds 30 percent ownership of an office building in Manhattan at 1290 Avenue of the Americas, for which four lenders, including the state-owned Bank of China, provided a $950 million loan in 2012. Commenting on the loan, Richard Painter, George W. Bush’s chief White House ethics lawyer, stated, “Any payments from foreign governments or payments from banks controlled by foreign governments would fall under the emoluments clause. The loans from the Bank of China could be an issue.” The Emoluments Clause of the U.S. Constitution makes it illegal for a U.S. president to directly benefit from payments from foreign powers.

The reach of Chinese influence and money has also been linked to the president’s son-in-law, Jared Kushner. In 2016, Kushner Companies, which until recently was headed by Jared Kushner, was desperate to find outside money to put into a property at 666 Fifth Avenue for which his company had paid $1.8 billion in 2007—an outlandish overpayment in light of the subsequent 2008 market crash. The Fifth Avenue property was badly overleveraged and risked collapsing Kushner’s entire company. Once again, Chinese money seemed eager to come to the rescue. Kushner began talks with the massive Chinese financial firm Anbang Insurance Group to undertake a joint venture to redevelop the Fifth Avenue property.

Anbang is one of the most aggressive Chinese buyers of U.S. real estate and has allegedly very close ties to the Chinese government. Its shadowy structure has caused suspicion about its real ownership and has led some U.S. firms to not work with the company because it doesn’t meet their client information guidelines. Anbang is headed by Wu Xiaohui, who is married to the granddaughter of former Chinese Vice Premier Deng Xiaoping.

The talks to secure the potential $4 billion deal between the Kushner and Anbang companies, however, reportedly ended a few days after Democratic lawmakers wrote letters to the Office of the White House Counsel and the treasury secretary expressing ethical and legal concerns over the deal. A Kushner spokesman declined to comment further to reporters about the deal ending.

And while Kushner has now stepped down from the Kushner family business, he will still be a beneficiary of much of the business through his trusts. The reverse is true as well: It appears that the family is trying to cash in on Jared Kushner’s new role as a White House senior adviser. According to The Washington Post, representatives from Kushner Companies, including Jared’s sister Nicole Kushner Meyer, recently gave a presentation to Chinese citizens in Beijing encouraging them to each invest $500,000 in the family’s Trump-branded New Jersey luxury apartment complex in exchange for an EB-5 immigrant investor visa. Known in China as the “golden visa,” the immigrant investor visa allows wealthy foreigners who provide large amounts of funding to U.S. projects that create jobs to apply for a visa and immigrate to the United States. As reported by Bloomberg, prior to taking on his role in the White House, Jared Kushner had raised $50 million from Chinese immigrant investor visa applicants for the New Jersey project. Ethics experts, including Painter, criticized the event, with Painter noting in a Washington Post article that the company “clearly impl[ies] that the Kushners are going to make sure you get your visa. … They’re [Chinese applicants] not going to take a chance. Of course they’re going to want to invest.” The Kushner company spokesperson declined to comment on the Post’s story.

The Chinese Communist Party’s links to Trump go even further. In 2008, the state-controlled Industrial and Commercial Bank of China (ICBC)—which reports to the CPC and is currently the world’s largest lender—signed a lease for the 20th floor in Trump Tower in New York City. The lease is slated to end in October 2019, meaning that a new lease will have to be negotiated while Trump is in office if the ICBC decides to renew. According to Bloomberg, the latest available data from Wells Fargo filings show that as of 2012, the ICBC was Trump Tower’s biggest office tenant, taking up 11 percent of its office space, and was paying more than any other major tenant in Trump Tower at $95.48 per square foot. According to data from CoStar Group, the deal has been worth more than $1.5 million annually to the Trump Organization. Many see the relationship between Trump and the ICBC as already violating the Emoluments Clause of the constitution, while others view it as a potential area for future violations of the clause, notably if Trump receives payments from the ICBC that are above market value.

In addition, the China Export and Credit Insurance Corporation, a state-controlled company in China also known as Sinosure, is reportedly investing $425 million in one of Trump’s resorts in Indonesia, specifically for a theme park to be built by another Chinese state-owned company.

And, not surprisingly, Ivanka Trump also seems to be suddenly benefitting from all this newfound Chinese largesse. On the very same day that President Trump and Ivanka met with Chinese President Xi Jinping, China preliminarily approved three new trademarks for Ivanka’s brand to cover jewelry, bags, and a spa service.

Since Trump’s inauguration, Ivanka Trump Marks LLC has been granted preliminary approval of at least five trademarks in China, bringing the total number of registered trademarks for the company to 16, with 30 pending applications. While Ivanka no longer manages her brand, she still owns it. In an attempt to address potential conflict of interest issues, she put her brand’s assets in a family-run trust, which is worth more than $50 million, and pledged to recuse herself from issues that might present conflicts.

Conflict of interest laws bar federal officials, such as Ivanka and her husband, from participating in government affairs that could potentially impact their own financial interests or those of their spouses—a standard that they seem to not be meeting by any fair reading. Ivanka’s lawyer, Jamie Gorelick, has stated that Ivanka and her husband would avoid specific areas that could impact her business and be seen as conflicts of interest but that they are not under a legal obligation to step back from large areas of policy, such as trade with China. Gorelick also noted that Ivanka would recuse herself from conversations pertaining to duties levied on clothing imported from China but not on broad foreign policy.

In an example that highlights the potential dangers of these conflicts, The Guardian recently reported that a labour rights activist who was working undercover to investigate abuses at a Chinese factory producing Ivanka Trump-brand shoes is being held by police and two other labor activists were missing, “raising concerns the company’s ties to the US president’s family may have led to harsher treatment.” The executive director of the group investigating the factory, Li Qiang, said that the missing activists were preparing to publicly allege labor violations at the factory, “including paying below China’s legal minimum wage, managers verbally abusing workings and ‘violations of women’s rights.’” Li noted that he had contacted the Ivanka Trump brand about the violations on April 27 to request that the brand call on suppliers to comply with Chinese law but did not see evidence that any changes were made. The Ivanka Trump brand declined to comment to The Guardian, and calls to the factory owner went unanswered.

Follow the paper trail

According to President Trump’s July 2015 financial disclosure—which was not verified by regulators and therefore may not include all of his foreign deals or assets—Trump owned, had ownership interest in, or was a managing member of several companies related to potential business in China, including the following:

- THC China Development LLC, president

- Value: $100,001 to $250,000

- Income amount: “None (or less than $201)”

- THC China Development Management Corp., chairman, director, president

- THC China Technical Services LLC, member, president

- THC China Technical Services Manager Corp., chairman, director, president

- THC Services Shenzen LLC, member, president

- THC Services Shenzen Member Corp., chairman, director, president

- THC Shenzen Hotel Manager LLC, member, president

- THC Shenzen Hotel Manager Member Corp., chairman, director, president

According to President Trump’s May 2016 financial disclosure—which also was not verified by regulators and therefore may not include all of his foreign deals or assets—Trump owned, had ownership interest in, or was a managing member of several companies related to potential business in China, including the following:

- China Trademark LLC, member, president

- THC China Development LLC, president

- Value: $1,001 to $15,000

- Income amount: “None (or less than $201)”

- THC China Development Management Corp., chairman, director, president

- THC China Technical Services LLC, member, president

- THC China Technical Services Manager Corp., chairman, director, president

- THC Services Shenzen LLC, member, president

- THC Services Shenzen Member Corp., chairman, director, president

- THC Shenzen Hotel Manager LLC, member, president

- THC Shenzen Hotel Manager Member Corp., chairman, director, president

All of these obvious conflicts of interest should give Americans pause. If Donald Trump negotiates a trade deal with China, will he accept terms that will cost American workers jobs but help his hotel brand? If China makes aggressive military moves in Asia, will President Trump fail to effectively respond because he is worried about jeopardizing his daughter’s trademarks in Beijing or losing Chinese financing for his properties? Americans can have no confidence that Trump’s decisions aren’t being driven by his business interests in China when he won’t release his tax returns. Already Trump has shown a pattern of backing down in the face of Chinese demands, as shown by his abrupt shift on the “one China” policy at Chinese President Xi Jinping’s request. When trying to explain Trump’s new subservience to China, one need look no further than his business interests.

Read the full series of columns here.

Carolyn Kenney is a policy analyst with the National Security and International Policy team at the Center for American Progress. John Norris is a senior fellow at the Center.